In the fast-paced world of finance, cryptocurrency is making waves. Among the emerging trends, BRICS cryptocurrency is a topic that’s gaining traction. It’s an innovative concept brought to life by the BRICS nations – Brazil, Russia, India, China, and South Africa, designed to reshape the global financial landscape.

This digital currency is set to challenge the traditional banking system, promising a future where transactions are faster, cheaper, and more secure.

BRICS Cryptocurrency

What Is BRICS?

BRICS is an alliance of five major emerging national economies: Brazil, Russia, India, China, and South Africa, formed in 2009 to reshape the global economic landscape through cooperation in trade and development. Over time, BRICS nations have expanded collaboration to include exploration of innovative digital technologies like cryptocurrency.

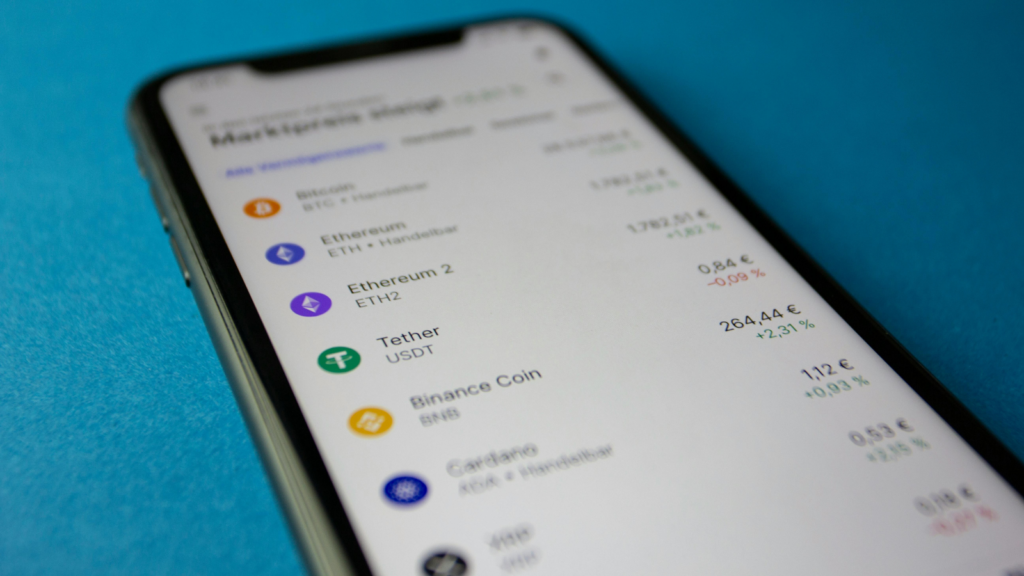

Cryptocurrency has gained traction in BRICS nations for its potential to reshape financial systems, offering secure, transparent, and decentralized exchange. Particularly significant to this group, it facilitates quick cross-border transactions, bypassing traditional banking procedures. Bitcoin and Ethereum play prominent roles in these countries, driving blockchain adoption. BRICS nations have explored the concept of a unified digital currency, aiming to enhance financial cooperation and spur economic growth.

Potential of a BRICS Crypto Asset

Following the initial emergence of the BRICS digital asset concept, the potential impact it could have on global finance is immense. As the concept continues to develop, two key areas to focus on include economic benefits and associated challenges.

Economic Benefits / Challenges and Considerations

BRICS cryptocurrency offers substantial economic advantages. Transactions occur rapidly, reducing costs and time delays typical in traditional banking. Remittance transactions, which often take days, can be completed within minutes or seconds using crypto technology. Additionally, cryptocurrency promotes financial inclusivity, providing secure transaction platforms for millions lacking traditional banking services. Developing a common digital currency among BRICS nations fosters financial cooperation, facilitating cross-border transactions and stimulating economic growth through increased trade.

A unified BRICS virtual currency faces hurdles. Cryptocurrencies lack centralized control, posing regulatory challenges for governments. Volatility and cybersecurity risks, despite blockchain’s security, deter widespread acceptance. Realizing the potential requires careful planning.

Technological Infrastructure

While the economic gains of BRICS cryptocurrency seem promising, it’s crucial to evaluate the technological infrastructure supporting this initiative.

Blockchain Technology in BRICS Nations

Blockchain technology is integral to the BRICS blockchain currency, serving as a decentralized ledger for transactions. BRICS nations stand to benefit from transparent yet secure records, bolstering the credibility of their digital currency. India embraces blockchain in its financial systems through startups, while China leads in global blockchain patents despite initial hesitations. South Africa explores blockchain for financial efficiency, while Brazil and Russia invest in its integration.

Security and Transparency Challenges

Despite blockchain’s potential, security and transparency issues persist. Cybersecurity threats, like Brazil’s 2018 crypto theft, remain prevalent. While blockchain ensures public transaction records, privacy concerns arise from individual traceability. Decentralization also complicates regulation, posing risks such as Bitcoin money laundering. Addressing these challenges is crucial for realizing blockchain’s full potential in bolstering the BRICS cryptocurrency.

Legal and Regulatory Framework

Regulatory clarity is crucial for the BRICS crypto asset, alongside technological soundness. This article explores current legal regulations in BRICS countries and their implications for future digital currency policies.

Current Regulations in BRICS Countries

Unsurprisingly, regulations vary greatly across the BRICS nations, reflecting unique economic and political contexts.

- Brazil: Guidelines released in 2018 recognize cryptocurrencies as electronic currencies and securities.

- Russia: Russia’s “Digital Financial Assets” law defines cryptocurrency but prohibits its use for transactions.

- India: Currently, no specific framework exists, but a “digital rupee” is in development.

- China: Stringent regulations ban cryptocurrency trading and ICOs, but a state-backed digital currency is advancing.

- South Africa: Cryptocurrencies are regulated as “cyber-tokens.”

The Future of BRICS Cryptocurrency

The BRICS digital currency is a game-changer for financial cooperation among member nations, leveraging blockchain technology for secure and transparent transactions. However, it faces challenges like cybersecurity threats and varying regulations, underscoring the need for a unified legal framework to bolster security, enhance transparency, and curb illegal activities. As the BRICS nations navigate these issues, the success of their joint cryptocurrency may hold significant implications for the future of financial cooperation and digital currency.