In the dynamic world of digital currencies, cryptocurrency ETF list has emerged as a significant player. Offering a blend of the traditional finance world with the cutting-edge innovation of blockchain technology, these ETFs provide investors with a unique opportunity. They’re a bridge between the conventional stock market and the somewhat elusive realm of cryptocurrencies.

Cryptocurrency ETF List

What Is a Cryptocurrency ETF?

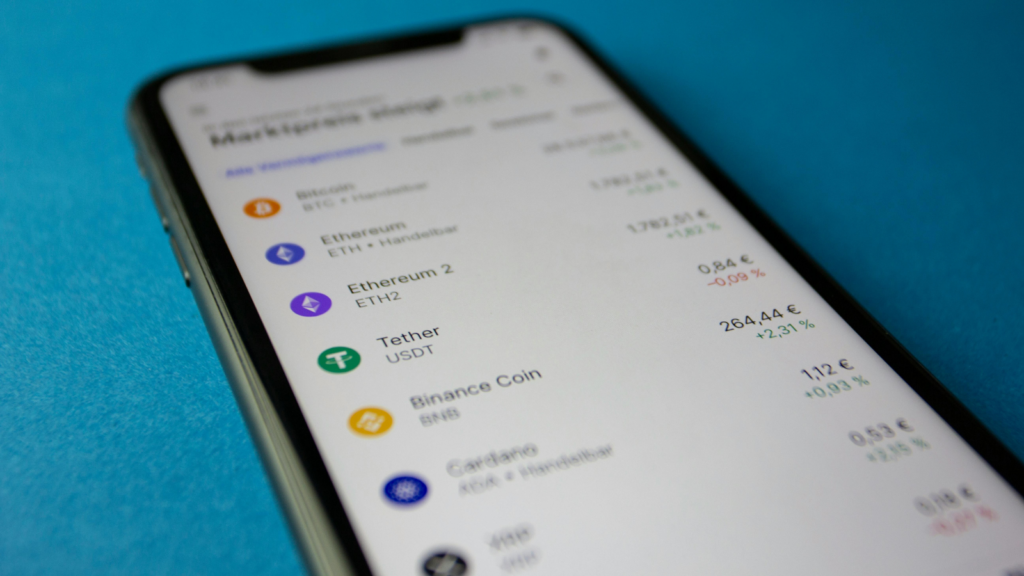

A Cryptocurrency ETF, in its essence, is a type of fund and exchange-traded product, just like conventional ETFs which track indexes of traditional financial markets, except it’s specifically designed to track the value of a cryptocurrency. Unlike direct crypto trading, investing in a Cryptocurrency ETF means purchasing shares of the fund, not the actual cryptocurrency. These funds usually track one crypto or a basket of different cryptocurrencies, making them a diversified tool for crypto exposure.

Benefits of Investing in Cryptocurrency ETFs

The primary benefit is simplicity. Individuals gain exposure to digital currencies without needing intimate knowledge of the trading landscape or the management of digital wallets, making these ETFs a perfect fit for the uninitiated.

Robust liquidity, which are inherent to ETFs, is another strength, enabling rapid execution of buy and sell orders at fair market prices. Contradictory to a single cryptocurrency investment, a Cryptocurrency ETF offers a diversified portfolio, spreading the risk across multiple digital currencies.

Moreover, Cryptocurrency ETFs fall under the regulation of financial market regulators, such as the Securities and Exchange Commission (SEC) in the U.S., bringing about an additional layer of legitimacy and investor protection compared to the less-regulated world of cryptocurrencies.

Key Players in the Cryptocurrency ETF Market

Notable Cryptocurrency ETFs and Their Performance

Grayscale Bitcoin Trust (GBTC) and CoinShares’ Physical Ethereum (ETHE) represent two excellent examples of noteworthy Cryptocurrency ETFs. Grayscale Bitcoin Trust tracks the market price of Bitcoin, and CoinShares’ Physical Ethereum mirrors the performance of Ethereum – it’s the first physically backed Ethereum ETF in the world. Both have yielded impressive returns for their investors despite the known volatility of cryptocurrencies. For instance, in 2020, Grayscale Bitcoin Trust reported an 800% return, while CoinShares’ Physical Ethereum enjoyed a surge of around 450%.

How to Choose the Right Cryptocurrency ETF

Selecting the right Cryptocurrency ETF depends primarily on two factors: risk tolerance and investment goals. In essence, research into the ETF’s past performance, underlying assets, and reputation of the management firm aids in the decision-making process.

Regulatory oversight, another essential aspect, provides an added layer of security. Remember, as with all investments, the potential for high returns carries a correlating risk. Stay informed, stay cautious, and make sound investment decisions.

How to Invest in Cryptocurrency ETFs

Diving deeper into the realm of Cryptocurrency ETF list, understanding the investment process becomes a crucial aspect. Here’s how one can make the step towards purchasing these ETFs, and the potential pitfalls one might encounter in their investment journey.

Steps to Buy Cryptocurrency ETFs

- Brokerage Account: First things first, open a brokerage account. Examples include Charles Schwab, E*Trade, or Robinhood.

- Fund Availability: Check if the Cryptocurrency ETF you are interested in is available on your chosen platform. Not all platforms carry every Cryptocurrency ETF due to jurisdictional regulations or platform limitations.

- Research: Evaluate the ETF’s components, understanding the digital assets it tracks and its past performance, as it can provide a gauge for potential future returns.

- Purchase: Once you’ve done your diligence, purchase the Cryptocurrency ETF.

Note, the process might vary dependent on the chosen brokerage platform.

The Dynamic World of Digital Currencies

Cryptocurrency ETFs have emerged as a compelling fusion of traditional finance and blockchain technology, offering a regulated path for investors to gain exposure to digital assets. They’ve proven their worth with players like Grayscale Bitcoin Trust and CoinShares’ Physical Ethereum delivering impressive returns. However, it’s critical for investors to thoroughly research potential ETFs, considering factors such as risk tolerance, underlying assets, and managerial reputation. Investing in Cryptocurrency ETFs isn’t just about an interest in blockchain technology; it requires a comprehensive understanding of the investment process and the ability to navigate potential pitfalls. With the right approach and due diligence, investors can confidently traverse the evolving landscape of Cryptocurrency ETF list, leveraging their benefits for potentially lucrative outcomes.