In a world where digital coins are popping up faster than a cat meme on social media, it’s easy to feel lost in the crypto jungle. But fear not, savvy investor! The top cryptocurrency isn’t just a buzzword; it’s your ticket to potential fortune—or at least a good story to tell at parties.

Top Cryptocurrency

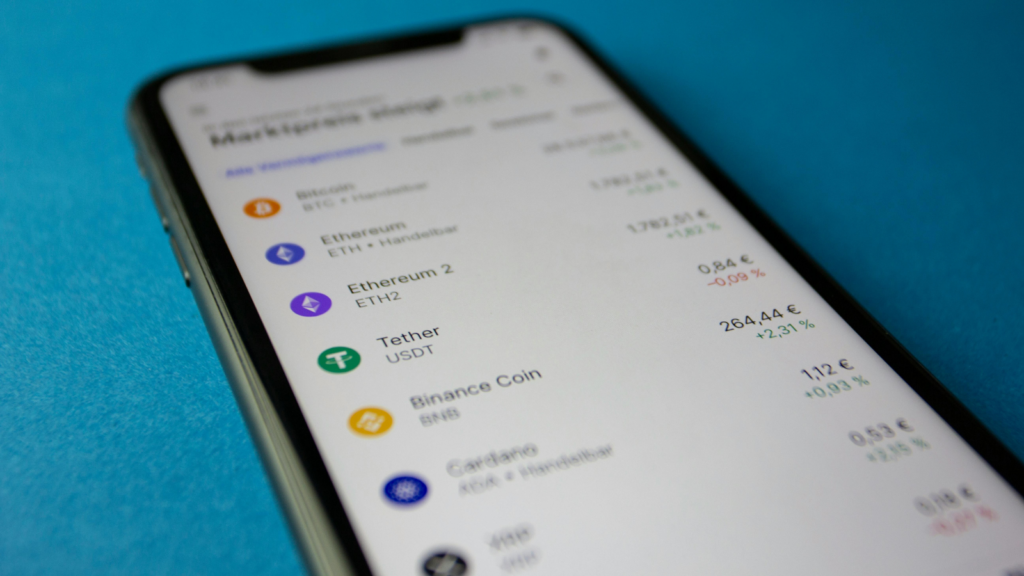

Cryptocurrencies represent a diverse range of digital assets, each with unique features and purposes. Bitcoin stands at the forefront, driving the cryptocurrency market since its inception in 2009. Ethereum follows closely, offering a platform for decentralized applications and smart contracts, which distinguishes it from its peers.

Other significant cryptocurrencies include Binance Coin, used primarily for trading on the Binance exchange, and Cardano, known for its focus on scalable and sustainable blockchain solutions. Ripple facilitates quick international money transfers, appealing to financial institutions globally.

Market capitalization plays a crucial role in determining a cryptocurrency’s significance. Bitcoin, with a market cap exceeding $800 billion, consistently leads the pack. Ethereum’s market cap amounts to over $400 billion, reflecting strong developer interest and continuous innovation.

Volatility remains a hallmark of the crypto market. Price fluctuations can be dramatic, impacting investment strategies. For instance, Bitcoin’s price surged past $60,000 in 2021, captivating media attention and investor interest.

Adoption of cryptocurrencies continues to rise. Retailers and businesses increasingly accept digital coins as payment, broadening the scope of their use. Institutional investment also grows, with hedge funds and publicly traded companies holding significant amounts of Bitcoin and Ethereum.

Investors should remain informed about market trends. Keeping an eye on regulatory developments and technological advancements can provide an edge. Following news from reliable sources and analyzing data from exchanges can help optimize investment decisions in the dynamic cryptocurrency landscape.

Popular Types of Cryptocurrency

Cryptocurrencies come in various forms, each highlighting unique features and utilities in the market.

Bitcoin: The Pioneer

Bitcoin remains the first and most recognized cryptocurrency. Since its launch in 2009, it has led the market with the highest market capitalization, surpassing $800 billion. Investors often view Bitcoin as digital gold, serving as a store of value. Its decentralized nature appeals to those seeking financial autonomy. While price volatility characterizes its trading, Bitcoin’s long-term trend continues upward. Many merchants now accept Bitcoin for transactions, enhancing its practical use in everyday life. With an established user base, Bitcoin frequently sets the standard for advancements in the entire cryptocurrency ecosystem.

Ethereum: The Smart Contract Leader

Ethereum stands out as a platform enabling smart contracts and decentralized applications. Its technology allows developers to create and deploy innovative blockchain-based solutions. Ethereum’s market cap exceeds $400 billion, showcasing strong market presence. Usage of its native token, Ether, allows for transactions within the network. Developers favor Ethereum for its versatility and established framework, focusing on the creation of decentralized finance applications. Major companies leverage its capabilities to enhance transparency and reduce costs. Continuous upgrades to the network, including Ethereum 2.0, aim to improve scalability and energy efficiency.

Binance Coin: The Exchange Favorite

Binance Coin serves as the native cryptocurrency for Binance, one of the largest exchanges globally. Users typically employ it to pay transaction fees, receiving discounts as an incentive. The coin’s popularity rose significantly due to extensive utility, including participation in token sales on the Binance platform. Market capitalization highlights its strength, positioning it among the top cryptocurrencies. Flexibility is a key benefit, as holders can use Binance Coin in various applications within the Binance ecosystem. Continuous developments and partnerships further expand its use cases. Committed to community engagement, Binance regularly enhances services to benefit its users.

Factors to Consider When Choosing a Cryptocurrency

Selecting the right cryptocurrency involves evaluating several key aspects. Investors often turn to market capitalization as an initial metric.

Market Capitalization

Market capitalization provides insight into a cryptocurrency’s relative size within the ecosystem. Bitcoin stands out with a market cap over $800 billion, significantly larger than Ethereum’s more than $400 billion. An investor may view higher market capitalization as a sign of reliability and acceptance. Analyzing market cap trends can indicate potential growth opportunities and investor sentiment towards specific coins.

Security Features

Security remains a top priority for cryptocurrency investors. Platforms utilizing advanced encryption and strong consensus mechanisms often exhibit higher trust among users. For instance, Bitcoin employs proof-of-work to secure its network. Ethereum is transitioning to proof-of-stake, enhancing energy efficiency and security. Regular audits and open-source code further contribute to a cryptocurrency’s credibility. Effectively assessing these security features can mitigate risks associated with potential hacks or fraud.

Use Cases and Utility

Understanding a cryptocurrency’s use cases can significantly influence investment decisions. Bitcoin serves primarily as a digital store of value, while Ethereum enables decentralized applications and smart contracts. Binance Coin enhances transaction efficiency on the Binance exchange. Cardano focuses on sustainable solutions for developers. Evaluating these functions helps determine a coin’s real-world application and growth potential in the ever-evolving market.

Future Trends in Cryptocurrency

The cryptocurrency landscape evolves rapidly. Investors should pay attention to emerging trends to assess future opportunities effectively.

Regulatory Developments

Regulations play a critical role in shaping the cryptocurrency market. Governments globally work to establish frameworks that ensure security and compliance, enhancing trust among users. In the United States, agencies like the SEC and CFTC address regulatory guidelines, affecting trading practices and initial coin offerings (ICOs). Countries such as China and India have taken both restrictive and promotional stances, influencing global market dynamics. Businesses also respond to regulations, creating compliance strategies that bolster investor confidence. The ongoing dialogue between regulators and the crypto community may lead to clearer guidelines, which could further drive mainstream adoption.

Technological Advancements

Technological progress drives innovation in cryptocurrency. Developments in blockchain technology focus on enhancing scalability, security, and transaction speed. Layer-2 solutions like the Lightning Network offer faster Bitcoin transactions, while Ethereum explores upgrades through Ethereum 2.0, introducing proof-of-stake protocols. Meanwhile, decentralized finance (DeFi) applications expand financial services, providing users with more alternatives for lending and borrowing. Non-fungible tokens (NFTs) continue to gain traction, transforming digital ownership across various sectors. As technologies mature, they could reshape the overall cryptocurrency landscape, inviting new users and investors.

Conclusion

Navigating the world of cryptocurrencies can be daunting yet rewarding. Understanding the top cryptocurrencies equips investors with the knowledge needed to make informed decisions. With Bitcoin and Ethereum leading the pack and other notable coins carving their niches, the potential for financial gain is significant.

As the market evolves with increasing adoption and technological advancements, staying updated on trends and regulatory changes is crucial. This dynamic environment offers opportunities for those willing to research and adapt. Embracing this journey could lead to exciting prospects in the ever-changing landscape of digital currencies.