In a world where digital coins can make you a millionaire overnight—or leave you wondering why you didn’t just stick to your piggy bank—cryptocurrency prices are the talk of the town. With Bitcoin soaring to the moon one day and plummeting back to Earth the next, keeping up with these wild price swings is like trying to catch a greased pig at a county fair.

Investors are glued to their screens, hoping to decode the next big trend while dodging the emotional rollercoaster that comes with it. Whether you’re a seasoned trader or just dipping your toes into the crypto pool, understanding these price movements can make all the difference. So buckle up as we dive into the fascinating world of cryptocurrency prices and explore what’s really behind those dizzying highs and lows.

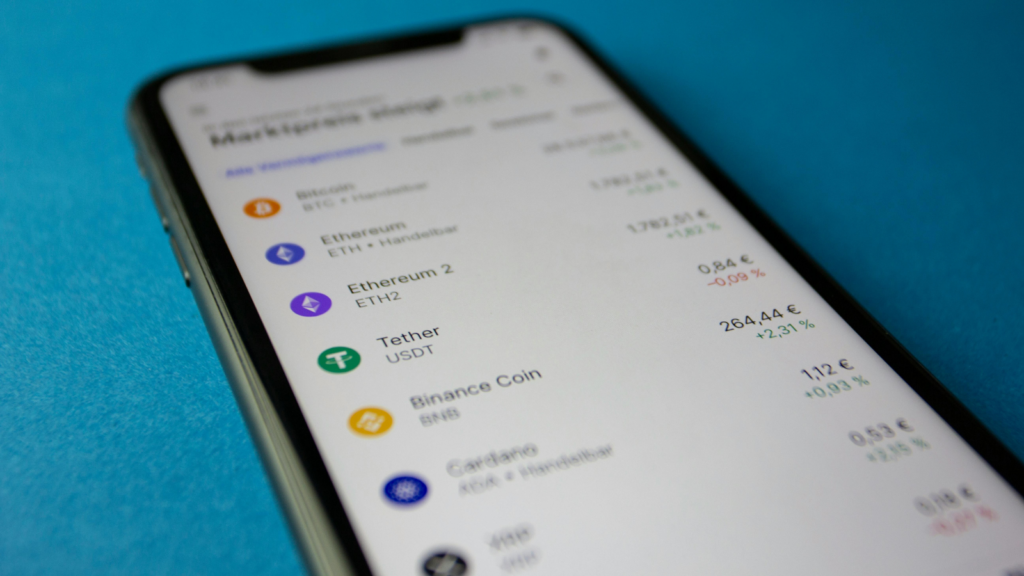

Cryptocurrency Prices

Cryptocurrency prices exhibit significant volatility, often shifting dramatically in short periods. Bitcoin, being the first and most prominent digital coin, frequently serves as a benchmark for market trends. Many factors contribute to these price movements, including regulatory news, market sentiment, and technological advancements.

Market analysis shows that positive news can lead to surges in prices, while negative reports tend to trigger sharp declines. Supply and demand dynamics play a crucial role; a limited supply of some coins can inflate their prices when demand increases.

Volatility presents opportunities as well as risks for traders. Day traders often capitalize on price fluctuations to achieve quick profits. Long-term investors, on the other hand, might focus on the gradual appreciation of specific cryptocurrencies.

Analysts use various tools to track price movements. Technical analysis combines chart patterns with trading volume, helping traders make informed decisions. Fundamental analysis evaluates the intrinsic value, considering the project’s technology, team, and market potential.

Current data reflects ongoing shifts. As of late 2023, Bitcoin is valued around $30,000, while Ethereum hovers near $2,000. Other altcoins, such as Cardano and Solana, may have different price ranges, influenced by project developments and overall market trends.

Tracking cryptocurrency prices requires a comprehensive understanding of the complex factors at play. Investors must stay informed to navigate this fast-paced market effectively.

Factors Influencing Cryptocurrency Prices

Factors significantly shape cryptocurrency prices, reflecting a complex interplay of elements that traders and investors must consider.

Market Demand and Supply

Supply and demand dynamics govern cryptocurrency prices. When demand increases and supply remains constant, prices tend to rise. Limited supply, particularly for assets like Bitcoin, often leads to higher valuations during bullish market trends. Conversely, when demand wanes, prices may drop sharply. Market participants track these fluctuations closely, analyzing trends to anticipate potential price movements. Increased participation from retail investors amplifies demand, which can drive prices upward.

Regulatory News and Events

Regulatory news plays a crucial role in shaping market sentiment. Announcements regarding government regulations can impact prices immediately, with positive developments often leading to price surges. For example, countries that embrace cryptocurrency can see increased investor interest and confidence. Alternatively, negative regulatory news can dampen prices, causing uncertainty among market participants. Laws surrounding taxation, trading platforms, and Initial Coin Offerings (ICOs) particularly affect investors’ outlooks.

Technological Developments

Technological advancements contribute significantly to price movements in the cryptocurrency market. Innovations that enhance scalability, security, or usability can positively influence investor sentiment. Projects that announce successful upgrades or partnerships often see their prices rise. Speed improvements for transactions, like those seen in Ethereum’s upgrades, can enhance functionality and attract more users. Conversely, security breaches or technological setbacks typically lead to sharp declines, emphasizing the importance of technology in valuation.

Historical Trends in Cryptocurrency Prices

Historical trends reveal the striking volatility of cryptocurrency prices. Investors witnessed extreme price movements, particularly those involving Bitcoin and Ethereum, underscoring the unpredictable nature of the market.

Major Price Fluctuations

Major fluctuations have defined cryptocurrency’s history. In December 2017, Bitcoin surged to nearly $20,000 before plummeting to around $3,000 by December 2018. Surges in demand alongside positive developments often fuel significant price increases. Conversely, unfavorable regulatory news or security breaches can trigger swift declines, demonstrating the market’s susceptibility to external factors. Such rapid fluctuations present opportunities for both day traders aiming for quick profits and long-term investors looking for sustained growth. Tracking these movements helps investors make informed decisions about their portfolios.

Lessons from Past Cycles

Lessons from past cycles offer valuable insights into market behavior. The dramatic rise and fall of Bitcoin in 2017 emphasized the importance of investor sentiment and market speculation. Following the crash in early 2018, many investors learned the necessity of risk management and diversification. Reviewing historical patterns also reveals how technological advancements can impact prices long-term. Successful upgrades, such as Ethereum’s network improvements, often catalyze price increases. Observing these cycles fosters a better understanding of potential future trends in cryptocurrency markets.

Current State of Cryptocurrency Prices

As of late 2023, Bitcoin stands at approximately $30,000 while Ethereum hovers around $2,000. Altcoins like Cardano and Solana experience price movements influenced by their development milestones. Price fluctuations remain significant due to various external factors affecting market dynamics.

Market demand drives fluctuations, with increased interest from retail investors causing prices to surge. Conversely, decreased demand can lead to sharp declines, creating volatility in the market. Regulatory news influences sentiment; positive announcements often result in price increases, while negative reports can suppress investor confidence.

Technological advancements continuously impact cryptocurrency values. Upgrades and innovations positively affect market sentiment and investor behavior. Security breaches, however, contribute to instability, leading to potential declines in prices.

Investors remain aware of historical trends that illustrate market unpredictability. Bitcoin’s ascent to nearly $20,000 in December 2017 followed by a drop to around $3,000 a year later highlights the extreme nature of these fluctuations. Such patterns can present opportunities for traders focused on both short-term gains and long-term investments.

Understanding the factors that influence price movements is essential for making informed decisions. Analysts use tools like technical and fundamental analysis to navigate trends. Risk management strategies and diversification can mitigate potential losses during market downturns.

Overall, the current state of cryptocurrency prices reflects a complex interplay of market demand, regulatory influence, and technological change. Monitoring these components can assist investors in capitalizing on opportunities while managing risks effectively.

Future Predictions for Cryptocurrency Prices

Analysts anticipate continued volatility in cryptocurrency prices. Bitcoin’s status as a benchmark suggests its movements will heavily influence the market. Price predictions often consider current supply and demand dynamics, with fluctuations likely occurring as new retail investor interest surfaces. Token developments, notably from altcoins like Cardano and Solana, could lead to price changes based on project advancements.

Regulatory developments equally play a critical role in future price movements. Positive regulatory clarity can foster investor confidence, potentially driving prices upward. Conversely, negative regulations may prompt declines, affecting overall market sentiment. Historical patterns illustrate that significant events, such as technological upgrades, tend to spark short-term rallies in price.

Technical analysis remains a go-to tool for many traders. Metrics such as trading volume and moving averages help interpret price trends. Utilizing such analysis may provide insights into potential movements and help in making informed trading decisions. Long-term trends often stem from broader market conditions, including macroeconomic factors affecting investor behavior.

Market sentiment continues to shift based on news and events in the cryptocurrency space. Investors tend to react strongly to price swings, heightening volatility. Keeping abreast of news can help individuals navigate potential risks associated with sudden changes.

Forecasts for the coming months suggest a stronger price focus on major events such as upcoming blockchain upgrades or significant partnerships. Analysts will watch these developments closely, contributing to ongoing discussions surrounding future price trajectories. Current prices, around $30,000 for Bitcoin and near $2,000 for Ethereum, will remain targets for traders as they monitor market shifts.

Conclusion

Navigating the cryptocurrency market requires a keen understanding of the factors that drive price fluctuations. As investors face the challenges of volatility they must remain vigilant about market trends and news. The interplay between demand, regulatory developments, and technological advancements will continue to shape the landscape.

With Bitcoin and Ethereum leading the way it’s crucial for both new and experienced traders to stay informed. By leveraging tools like technical analysis and maintaining a diversified portfolio investors can better manage risks. As the market evolves the potential for significant gains remains intertwined with the unpredictability that defines cryptocurrency prices. Staying proactive and adaptable will be key in this dynamic environment.