In a world where digital coins are popping up faster than cat videos, understanding cryptocurrency market cap is crucial for anyone looking to navigate this financial jungle. It’s like a popularity contest for coins, but instead of high school drama, it’s all about value and potential. If you think your favorite altcoin is the next big thing, the market cap might just be the ultimate judge.

Market cap isn’t just a number; it’s the key to unlocking insights about the health of the crypto market. It reveals how much investors are willing to bet on a coin, giving a glimpse into trends and opportunities. So, whether you’re a seasoned trader or just dipping your toes into the crypto waters, grasping the concept of market cap could be your ticket to making informed decisions—and maybe even snagging that elusive moonshot.

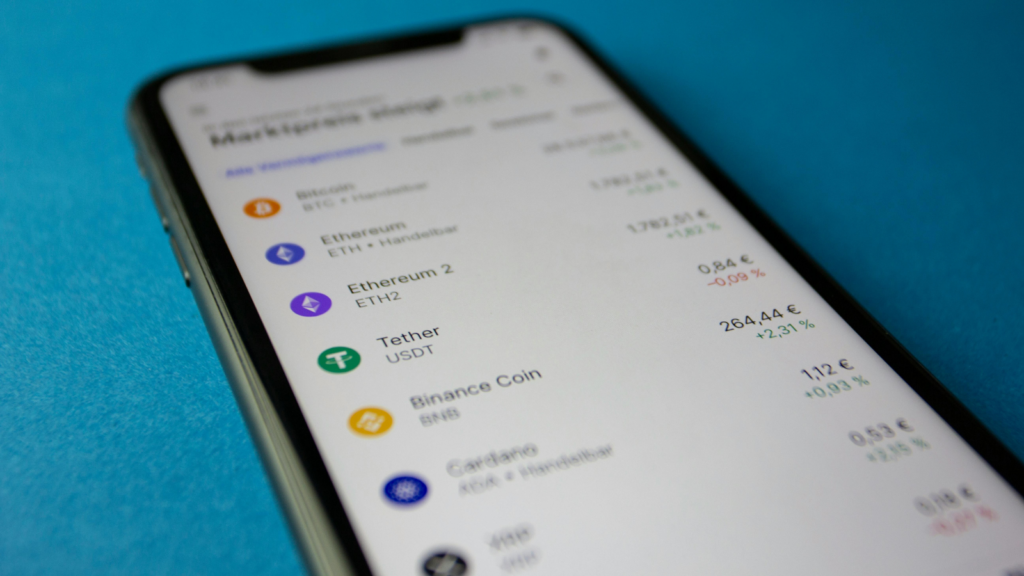

Cryptocurrency Market Cap

Cryptocurrency market cap serves as a key indicator of a cryptocurrency’s value and performance in the digital landscape. Comprehending this metric aids in evaluating various opportunities across different coins.

Definition of Market Cap

Market cap, or market capitalization, quantifies the total value of a cryptocurrency. It calculates by multiplying a cryptocurrency’s current price by its circulating supply. For example, if a coin costs $50 and has a circulating supply of 1 million coins, its market cap reaches $50 million. This figure helps investors gauge a cryptocurrency’s size within the market, with higher market caps generally signifying greater stability and recognition.

Importance in Cryptocurrency

Market cap holds significant importance in cryptocurrency investment decisions. Observing market caps aids investors in understanding relative value among different cryptocurrencies. Larger market cap coins often represent lower volatility and more established projects. Smaller market caps, however, might indicate higher risk yet present opportunities for substantial growth. Spotting trends in market cap changes reveals shifts in investor sentiment and can influence purchasing strategies while providing insight into potential future developments in the crypto market.

Key Factors Influencing Market Cap

Market cap reflects the dynamics of the cryptocurrency market. Various factors significantly affect the market cap, shaping investor behavior and asset evaluation.

Supply and Demand

Supply and demand fundamentally drive the cryptocurrency market. An increase in demand often leads to higher prices, consequently raising market cap. Conversely, a surplus of coins without matching demand can decrease prices and market cap. For instance, Bitcoin’s limited supply creates scarcity, enhancing its demand and overall market value. A growing interest in new projects can also create fluctuations in market cap as investors seek to capitalize on anticipated growth in circulating supply.

Market Sentiment

Market sentiment plays a crucial role in determining market cap. Positive news, like regulatory acceptance of cryptocurrencies, often boosts investor confidence and interest, resulting in increased market cap. Conversely, negative events, such as security breaches, can erode trust, leading to a drop in market cap. Social media trends and influential endorsements can rapidly shift sentiment, affecting the valuation of cryptocurrencies. For example, viral endorsements on platforms like Twitter can spark surges in trading activity, significantly impacting market cap.

Major Players in Cryptocurrency Market

The cryptocurrency landscape features significant players shaping its dynamics. Understanding their roles aids in navigating investment opportunities.

Bitcoin and Its Dominance

Bitcoin remains the market leader, commanding approximately 40% of the total cryptocurrency market cap. Created in 2009, its pioneering technology and brand recognition set the foundation for digital currencies. Many view Bitcoin as a store of value akin to digital gold. Its limited supply of 21 million coins contributes to its scarcity and drives demand. Price fluctuations impact investor sentiment throughout the market. Market participants often use Bitcoin’s performance as a benchmark to assess the overall health of the cryptocurrency sector.

Altcoins and Their Roles

Altcoins play critical roles in diversifying the cryptocurrency market. Ranging from Ethereum to Ripple, these coins offer different functionalities and use cases. Ethereum, for instance, supports smart contracts and decentralized applications, enhancing its value proposition. Other altcoins, such as Litecoin and Cardano, target transaction speed and scalability challenges. As the market evolves, new projects frequently emerge, offering innovative solutions. Traders and investors track these developments closely, as many altcoins provide opportunities for exponential growth, albeit with increased volatility. Overall, altcoins contribute significantly to the market’s diversity and function.

Analyzing Market Cap Trends

Understanding market cap trends sheds light on cryptocurrency evolution and market behavior. Investors track historical growth and current trends to make informed decisions.

Historical Growth Patterns

Historical market cap patterns illustrate crypto volatility. In 2017, Bitcoin’s market cap surged from $15 billion to over $600 billion. Subsequently, Ethereum’s rise highlights altcoins’ potential; its market cap jumped from $1 billion to $30 billion in the same timeframe. Periodic spikes in market caps demand closer analysis to identify possible implications for future investments. Recognizing these variations aids in discerning the overall health of the cryptocurrency market.

Current Market Trends

Current market trends reflect significant shifts in investor sentiment. Recent data indicates that Bitcoin retains approximately 40% dominance in the total market cap. Despite fluctuations, altcoins continue to gain traction; Ethereum and Ripple’s growing market caps signal robust interest in diverse blockchain applications. Investor interest often diverges, with smaller market cap cryptocurrencies attracting attention for high-risk, high-reward potential. Global economic factors also influence current trends, affecting demand and market stability. Observing these trends equips investors with the knowledge they need to navigate the digital currency landscape effectively.

Future of Cryptocurrency Market Cap

The future of cryptocurrency market cap looks promising, driven by technology advancements and growing adoption of digital currencies. Increased interest from institutional investors plays a pivotal role in shaping the market, as firms seek exposure to cryptocurrencies as alternative assets. Innovative financial products, such as crypto exchange-traded funds (ETFs), offer new investment avenues and enhance market participation.

Technological improvements in blockchain scalability and efficiency are crucial. Better scalability solutions can accommodate a larger number of transactions, potentially leading to higher market cap for various cryptocurrencies. Projects focused on interoperability also contribute significantly, enabling different blockchains to communicate and exchange value seamlessly.

Regulatory clarity impacts future developments. Governments and regulatory bodies worldwide seek to establish frameworks that legitimize and protect investors in the crypto space. Clear regulations can enhance market stability and attract traditional investors, fostering confidence within the ecosystem.

Emerging applications of blockchain technology influence trends as well. Financial services, supply chain management, and digital identity management projects leverage blockchain to increase efficiency and transparency. These use cases highlight the versatility and potential for growth in the cryptocurrency market.

Adoption rates will dictate market expansion. As more businesses accept cryptocurrencies for payments, demand will likely rise, pushing market caps higher. Enhanced public awareness through education campaigns can aid adoption, ensuring a steady influx of new investors.

Volatility remains a characteristic trait of cryptocurrencies, but understanding price movements through market cap will enable investors to make informed decisions. Analysts will monitor shifts closely, reinforcing the significance of market cap as both an indicator of current standing and future potential of diverse digital currencies.

Conclusion

Understanding cryptocurrency market cap is essential for anyone looking to navigate the complex world of digital currencies. This metric not only reflects the current value but also provides insights into market trends and investor sentiment. By keeping an eye on market cap fluctuations, investors can identify potential opportunities and risks.

As the cryptocurrency landscape continues to evolve, recognizing the significance of market cap will empower both seasoned traders and newcomers alike. With the rise of innovative technologies and increasing institutional interest, the future of cryptocurrency market cap looks promising. Staying informed about these developments will be crucial for making strategic investment decisions in this dynamic market.