In a world where digital coins are the new gold, cryptocurrency exchanges have become the bustling marketplaces of the 21st century. Picture a vibrant bazaar where Bitcoin and Ethereum strut their stuff, flaunting their value like a peacock in full plumage. Whether you’re a seasoned trader or a curious newbie, navigating these platforms can feel like trying to solve a Rubik’s Cube blindfolded.

Cryptocurrency Exchange

Cryptocurrency exchanges serve as key platforms enabling users to buy, sell, and trade digital currencies. They facilitate transactions across various cryptocurrencies including Bitcoin, Ethereum, and many altcoins. These exchanges fall into two main categories: centralized and decentralized.

Centralized exchanges function as intermediaries, holding users’ funds and managing trades on their behalf. Examples include Coinbase and Binance, which provide user-friendly interfaces and high liquidity. User accounts typically require personal information verifying identity, aligning with regulatory compliance requirements.

Decentralized exchanges, on the other hand, operate without a central authority, allowing peer-to-peer trading directly between users. Platforms like Uniswap utilize smart contracts to execute trades, enhancing privacy and security. Traders maintain control over their funds, minimizing the risks associated with hacks on centralized platforms.

Fees associated with trades vary significantly between exchanges. Centralized platforms often charge transaction fees ranging from 0.1% to 0.5%, while decentralized exchanges might have higher gas fees due to blockchain network congestion. Users should evaluate these costs alongside the functions provided by each exchange.

Liquidity represents another crucial aspect of exchanges. High liquidity leads to quicker transactions and better price stability, essential for traders looking to execute large orders. Daily trading volumes can reach billions on top exchanges, reflecting their importance in the cryptocurrency ecosystem.

Security measures differ across exchanges, impacting user trust. Two-factor authentication, cold storage, and regular audits help safeguard assets on centralized exchanges. DeFi platforms depend on the security of underlying smart contracts, making thorough research necessary before trading.

Users must also consider ease of access, supported currencies, and features offered before selecting an exchange. Understanding these aspects ensures a more informed trading experience in the dynamic world of digital currencies.

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges vary significantly, influencing user experience and trading strategies. Understanding these types aids in selecting the right platform.

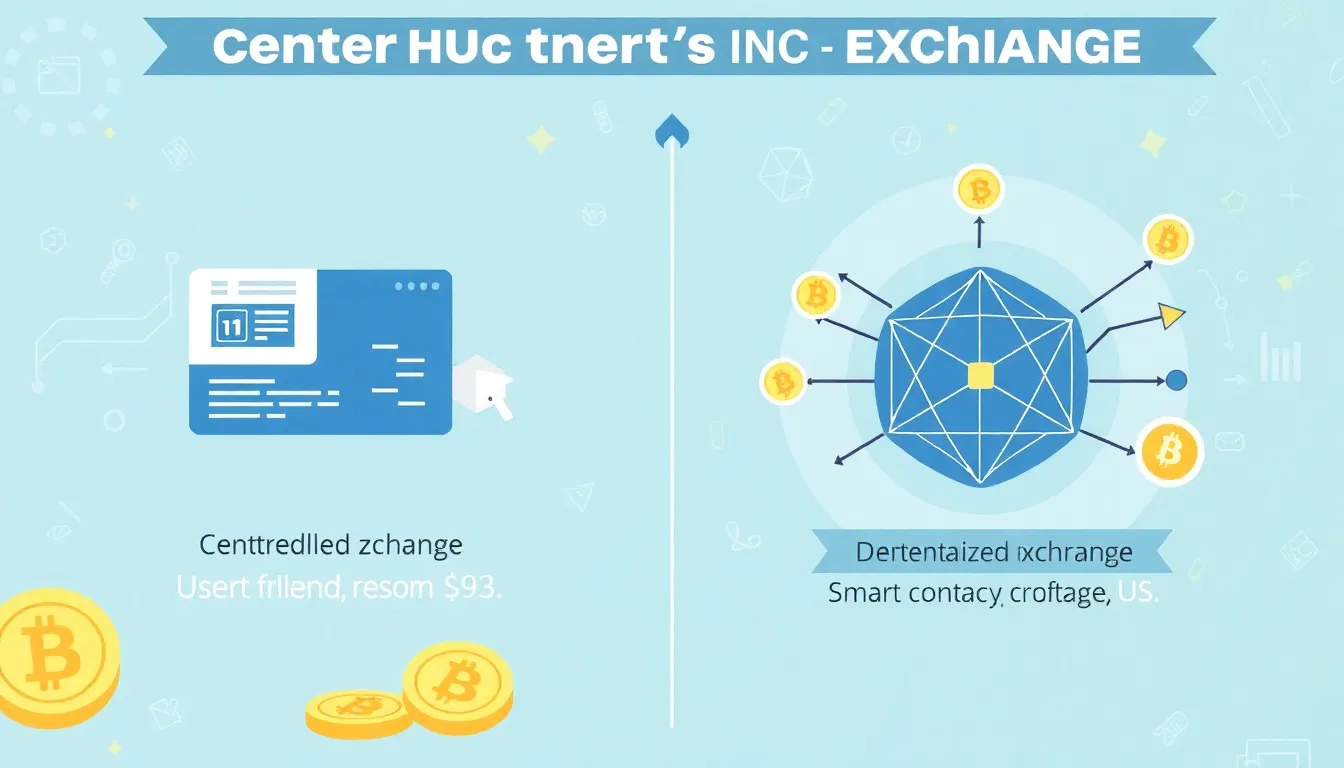

Centralized Exchanges

Centralized exchanges function as intermediaries in transactions. They manage order books and hold users’ funds, making them user-friendly for beginners. Examples include Coinbase and Binance. These exchanges require personal information to comply with regulatory standards. Liquidity tends to be high, allowing for quick trades and competitive pricing. Users often encounter lower fees compared to decentralized alternatives. Security measures like two-factor authentication and cold storage protect assets. Centralized exchanges appeal to those seeking stability and convenience in their trading journey.

Decentralized Exchanges

Decentralized exchanges operate differently, emphasizing privacy and security. They allow peer-to-peer trading directly between users, utilizing smart contracts. Examples like Uniswap and SushiSwap highlight this model. Users retain control of their funds, which mitigates risks associated with centralized platforms. While these exchanges often present higher transaction costs due to gas fees, they offer greater autonomy. Researching smart contracts becomes essential to ensure security in trades. Decentralized exchanges attract those valuing privacy and the opportunity for innovative trading experiences.

Factors to Consider When Choosing a Cryptocurrency Exchange

Choosing a cryptocurrency exchange requires careful consideration of various factors for an optimal trading experience.

Security Features

Security features play a crucial role in protecting users’ assets. Look for exchanges that implement two-factor authentication and cold storage, which can significantly reduce the risk of hacking. Users should also verify if the exchange has a history of security breaches. Strong security protocols, including encryption and compliance with regulations, enhance trustworthiness. Researching the insurance policies in place for digital assets provides added confidence in case of unforeseen events. In the current landscape of digital currencies, robust security measures are non-negotiable for prudent traders.

User Experience

User experience greatly influences how effectively individuals can trade cryptocurrencies. A user-friendly interface simplifies navigation for both novice and experienced traders. Intuitive design elements such as easy account creation and streamlined transaction processes create a more pleasant trading environment. Review available trading tools, educational resources, and mobile app functionality to gauge overall usability. Customer support availability also impacts user satisfaction, with responsive support teams providing assistance during trading issues. Choosing an exchange with a positive user experience can enhance trading efficiency significantly.

Fees and Commissions

Fees and commissions directly affect profitability in cryptocurrency trading. Most exchanges charge a variety of fees, including trading, withdrawal, and deposit fees. Comparing these fees across different platforms can reveal significant savings for active traders. Users should examine fee structures, as some exchanges offer tiered pricing based on trading volume. Hidden fees can dramatically alter overall costs, making transparency essential. Understanding the financial implications of fees helps traders select exchanges that align with their trading strategies and financial goals.

Top Cryptocurrency Exchanges Reviewed

This section evaluates notable cryptocurrency exchanges to aid users in making informed decisions. Below are key insights on two major exchanges.

Exchange A

Coinbase ranks among the most popular centralized exchanges. This platform offers a straightforward interface ideal for newcomers. Users appreciate the variety of supported cryptocurrencies, including Bitcoin and Ethereum. Coinbase implements robust security measures, such as two-factor authentication and insurance for user funds. Liquidity remains high, facilitating quick trades. Transaction fees vary based on payment methods, making it essential to consider cost structures. Customer support is accessible, providing guidance on trading and account management. Experience with Coinbase often fosters a sense of trust, contributing to its widespread adoption.

Exchange B

Binance stands as another leading cryptocurrency exchange, known for its extensive range of trading pairs. This platform caters to both beginners and experienced traders thanks to its advanced features. Users benefit from low trading fees, with options for discounted rates based on the use of Binance Coin. Security features, including withdrawal whitelist and two-factor authentication, enhance protection against unauthorized access. The user interface adapts to diverse trading styles, from standard to advanced. Binance also excels in liquidity, ensuring swift order execution. Its educational resources help users navigate the complexities of cryptocurrency trading effectively.

Conclusion

Navigating the world of cryptocurrency exchanges can be both exciting and challenging. By understanding the differences between centralized and decentralized platforms users can make informed decisions that align with their trading goals. Security features user experience and fee structures play crucial roles in selecting the right exchange.

As the cryptocurrency landscape continues to evolve staying updated on the latest trends and developments is essential. Whether opting for user-friendly platforms like Coinbase or exploring the decentralized options available users should prioritize their needs and preferences. With the right knowledge and tools anyone can confidently engage in the dynamic marketplace of digital currencies.