In a world where digital coins seem to multiply faster than rabbits, cryptocurrency stocks have hopped into the limelight, captivating investors with their promise of high returns. Picture this: while your traditional stocks are like a reliable old tortoise, crypto stocks are the energetic hare, racing ahead with the potential for explosive growth. But just like any thrilling race, there are twists and turns that every investor needs to navigate.

Cryptocurrency Stocks

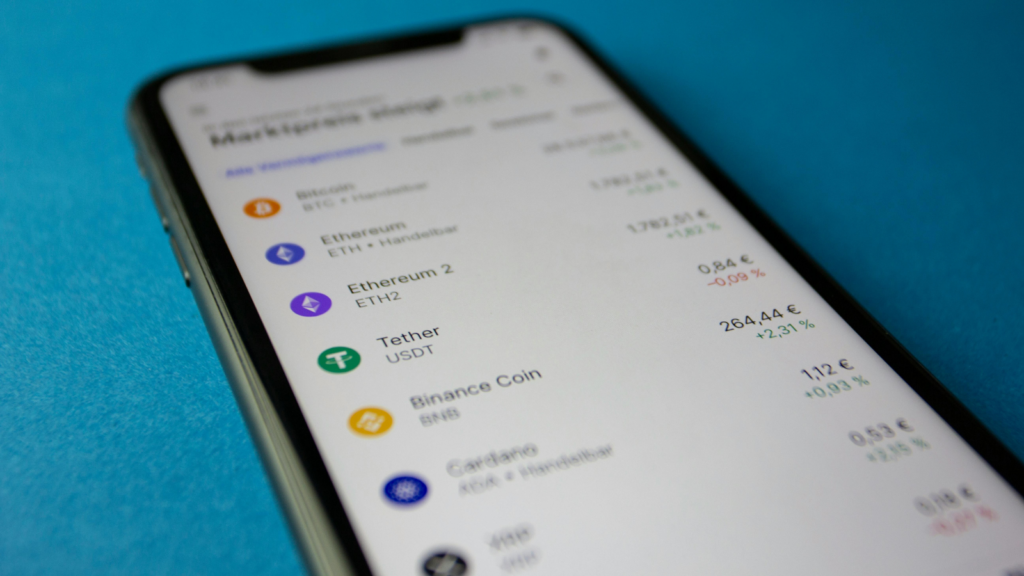

Cryptocurrency stocks represent shares in companies involved in the cryptocurrency ecosystem. Many of these companies operate exchanges, provide mining equipment, or develop blockchain technology. Investing in such stocks appeals to those seeking exposure to the digital currency market without directly purchasing cryptocurrencies.

Market performance for cryptocurrency stocks often correlates with the overall performance of major digital currencies. For instance, when Bitcoin experiences significant price movements, corresponding stocks frequently react, reflecting investor sentiments. Companies like Coinbase and Riot Blockchain see their stock values influenced by Bitcoin’s market behavior.

Risks associated with cryptocurrency stocks can be substantial. Volatility remains a critical factor, as these stocks can experience sharp price changes. It’s not uncommon for crypto stocks to rise or fall sharply within short periods. Investors should approach these assets with caution and conduct thorough research.

Potential for returns in this sector attracts risk-tolerant investors. Some cryptocurrency-related stocks have delivered returns exceeding 100% in a single year during market rallies. This potential profitability, however, accompanies the need for careful risk assessment and diversified portfolios.

In the current landscape, regulatory developments can impact cryptocurrency stocks significantly. Changes in government policies often affect the operational viability of companies within the sector. Staying informed about both market trends and regulatory news is vital for anyone looking to invest in this area.

The allure of cryptocurrency stocks continues to grow among investors. Their unique position within the financial markets offers opportunities, yet inherent risks necessitate informed decision-making. Individuals engaging with these stocks should balance risk and reward to maximize potential gains effectively.

Benefits of Investing in Cryptocurrency Stocks

Investors recognize numerous benefits in the cryptocurrency stocks market. High growth potential attracts many, while diversification opportunities enhance portfolio stability.

High Growth Potential

Investors experience significant gains with cryptocurrency stocks. Some stocks achieve over 100% returns within a year, showcasing the sector’s explosive growth. Companies that focus on mining, trading, and blockchain technology often yield high revenues as Bitcoin and other cryptocurrencies rise. Many investors find excitement in the fast-moving nature of these stocks. Rapid shifts in market demand can lead to substantial profits. Advanced technology and increasing acceptance of cryptocurrencies support continued expansion. Diversifying into cryptocurrency stocks may provide avenues for capturing impressive gains in the rapidly evolving landscape.

Diversification Opportunities

Diversifying a portfolio gains importance in today’s investment landscape. Cryptocurrency stocks offer alternative exposure to digital assets outside direct cryptocurrency purchasing. By including these stocks, investors spread risk across different asset types. Mining companies and blockchain developers may enhance overall portfolio resilience. Associations with established firms also provide indirect exposure to burgeoning technologies. Selecting various companies within the cryptocurrency ecosystem bolsters potential returns. Smart investment strategies lead to balancing portfolios, helping investors manage risk while seizing growth opportunities. This blend promotes a more stable investment foundation in an ever-fluctuating marketplace.

Risks Associated with Cryptocurrency Stocks

Investing in cryptocurrency stocks presents notable risks that demand attention. Both market volatility and regulatory challenges play significant roles in shaping the investment landscape.

Market Volatility

Market volatility remains a primary concern for investors. Price swings can be drastic, often exceeding 10% within a single day. Cryptocurrencies, such as Bitcoin, heavily influence the performance of related stocks. A sudden market downturn can lead to sharp declines in stock values, creating a risky environment for investors. Analysts noted that lack of liquidity can exacerbate these fluctuations, causing larger price impacts during trading. Investors must conduct thorough market analysis and stay updated on trends to mitigate potential losses. Awareness of these significant swings prepares investors for the unpredictable nature of this sector.

Regulatory Challenges

Regulatory challenges present additional risks in cryptocurrency stocks. Governments worldwide are forming new regulations that can affect how these companies operate. Changes in policy can lead to sudden impacts on stock prices, as investors react to potential compliance issues. Investigations and enforcement actions by regulatory bodies, such as the SEC, create uncertainty in the market. Investors should track regulatory updates to understand evolving risks. Staying informed about legislation regarding cryptocurrency companies positions investors to make smarter decisions despite regulatory hurdles. Ultimately, awareness of the regulatory landscape is crucial for navigating this complex market.

Top Cryptocurrency Stocks to Consider

Investing in cryptocurrency stocks provides exposure to the evolving digital currency market, combining potential rewards with the risks inherent in this sector. Here are some of the notable options to explore.

Established Companies

Established companies in the cryptocurrency space often present a more stable investment opportunity. Firms like Coinbase and Square stand out due to their substantial user bases and solid market positions. Coinbase, one of the largest crypto exchanges, regularly reports significant revenue growth, bolstered by transaction fees from trading activities. Square, known for its Cash App, integrates cryptocurrency features that cater to increasing consumer demand for digital currencies. Additionally, companies like Nvidia, which manufactures graphics processing units for crypto mining, benefit from surging interest as mining gains traction. Diversification in established firms offers a reliable path for investors seeking growth with reduced volatility.

Emerging Startups

Emerging startups offer high-growth potential, despite associated risks. Companies like Marathon Digital Holdings and Riot Blockchain focus on cryptocurrency mining, capitalizing on increasing energy and digital asset demands. Marathon Digital has made headlines with its aggressive expansion plans, aiming for higher hash rates to improve profitability. Riot Blockchain, similarly, has established partnerships to enhance its mining operations and increase output. Investing in these startups can yield impressive returns, as their stock prices often respond dramatically to market trends. While opportunities abound, careful evaluation of these companies and their business models is vital due to the inherent risks of investing in nascent enterprises.

Conclusion

Investing in cryptocurrency stocks offers a unique blend of high potential returns and significant risks. As the market evolves and more companies enter the cryptocurrency ecosystem, investors have the chance to capitalize on this dynamic sector. However, the volatility and regulatory challenges can’t be overlooked.

Staying informed and conducting thorough research is essential for navigating this fast-paced environment. By carefully selecting a mix of established firms and promising startups, investors can enhance their portfolios while managing risk effectively. As interest in digital currencies continues to grow, the landscape of cryptocurrency stocks will likely remain an exciting frontier for those willing to engage with its complexities.